1. Pulling a quote

If you’ve ever had to manually pull quotes for your clients, you know how time-consuming and laborious the process can be.

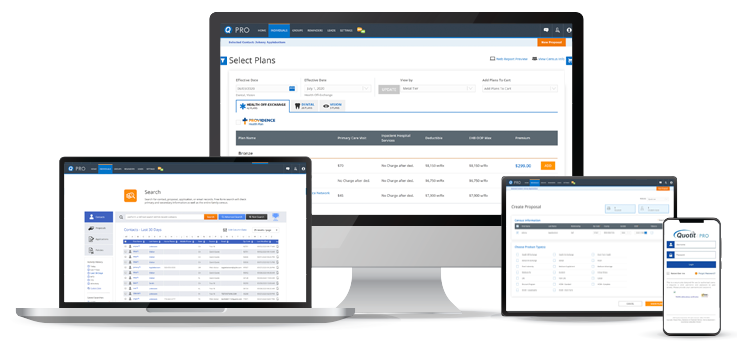

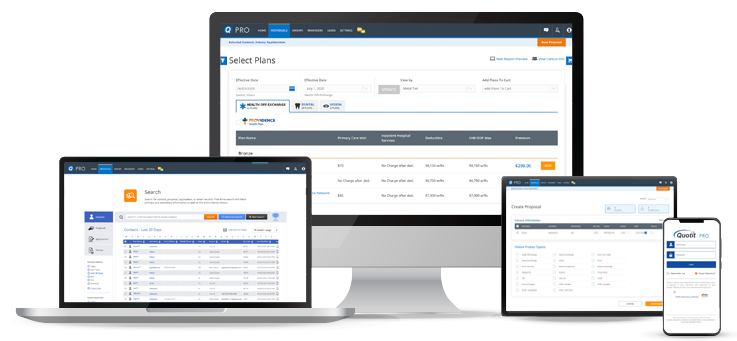

Quotit’s insurance agency software provides the fastest way to pull quotes for all kinds of insurance plans. Simply select your criteria (e.g., off-exchange health insurance in New York for a 50-year-old male), and your options will be quickly displayed, with all of the information you need to help your clients make the best decisions. Identify the best-fit policy options with more than 40,000 plans from 300-plus carriers.

2. Building a proposal

Traditionally, building proposals has also been a massive time suck—particularly because prospects and clients might not always agree to the proposals you send out. Quotit makes building proposals incredibly easy with a built-in wizard that guides you through the process quickly.

Just click on the type of product you’re looking for and indicate when the coverage should start. Instantly, a variety of qualified plans will pop up, and you can add the one you want to an Amazon-style shopping cart. Click on tabs to toggle between health insurance, dental, vision, accident, critical illness, and more to repeat the process. Once you’ve selected your options, you can review your proposal and send it over when you’re happy with it. Say goodbye to pulling detailed data, formatting it, distributing it, and tracking your progress by hand.

3. Comparing plans

Instead of forcing you to hop from site to site and tab to tab in your browser, Quotit enables you to easily compare a number of plans in a single view.

You’ll be able to see information about deductibles, coinsurance, copays, what’s covered, whether doctors are in-network, and more, side by side, making it that much easier to help clients find the plan that is perfect for their circumstances. Build truly customized plans for your clients based on their unique needs, and empower them to find solutions on their own.

4. Enrolling in plans

After you’ve spent hours helping a client find the plan that works best for them, the last thing you want is to have to devote even more time to completing the enrollment process.

Quotit makes it easier than ever to enroll in plans. In fact, the software enables clients to buy plans at their own convenience. All they have to do is enter basic information, answer a few questions about themselves, choose a payment option, review all of their information, and acknowledge the terms and conditions. It’s the fastest and easiest way to complete the health insurance enrollment process. Using one form, you can distribute information between multiple applications at once online, which can help you expedite the closing of a new customer.